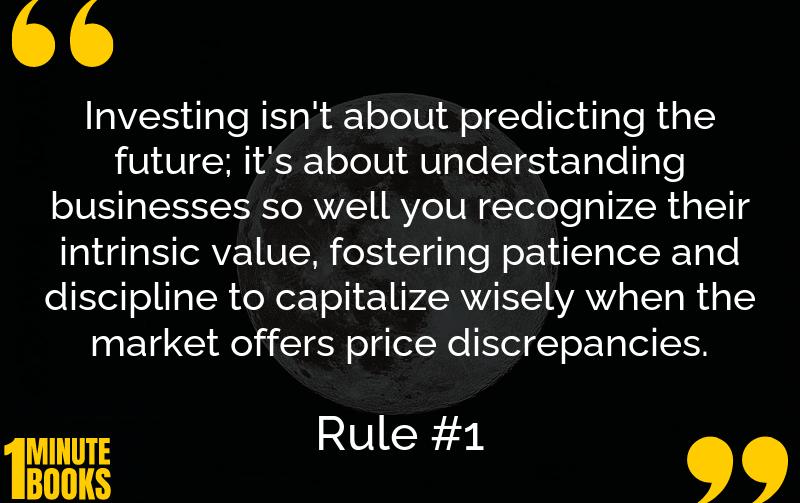

Phil Town’s ‘Rule #1’ demystifies stock market investing by promoting a simple strategy: find great businesses, determine their value, buy stocks at half that value. Embrace technology and reject myths for financial success.

Main Lessons

- Understand the power of buying stocks at half their true value to amass wealth.

- Reject the myth that investing is only for experts; you can succeed with available tools and knowledge.

- Use online resources like Yahoo Finance and investment calculators for informed decisions.

- Diversifying widely may not always guarantee safety; monitor individual stocks attentively.

- View stock investments as owning part of a business, promoting careful selection.

- Leverage personal expertise when choosing stocks in familiar industries for an edge.

- Ensure investment choices reflect personal values, as they represent a form of voting.

- Identify companies with strong ‘moats,’ which protect them from competition and drive profitability.

- Examine earnings, sales, and cash flow growth rates for clues on a company’s competitive edge.

- Choose investments led by owner-oriented CEOs, as they make informed long-term decisions.

- Demand a margin of safety when investing, ensuring the purchase price is well below value.

- Realize that price and value are distinct; use tools to identify genuine value opportunities.

- History shows the market doesn’t always reflect true value immediately; savvy patience is key.