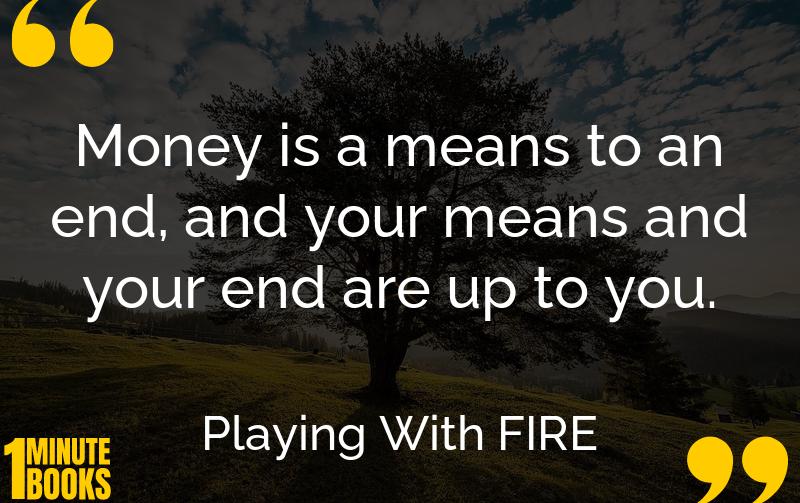

Playing With FIRE explores the Financial Independence, Retire Early (FIRE) movement through the author’s personal journey. It details strategies for financial independence centered around aggressive saving, frugal living, and investing wisely.

Main Lessons

- Financial independence represents freedom from the paycheck dependency cycle.

- The FIRE movement encourages saving 50-70% of income for early retirement.

- Investing in low-cost index funds is central to FIRE’s investment strategy.

- The ‘4% rule’ suggests living on 4% of your investments indefinitely.

- Focusing on reducing expenses in housing, food, and transportation is key.

- Spending alignments with happiness can redefine personal values and priorities.

- Building a supportive FIRE community can help sustain motivation.

- Increasing income through side hustles can accelerate reaching financial goals.

- The magic of compound interest enhances long-term wealth building.

- An inventory of personal happiness can reveal non-material joys.

- FIRE challenges traditional retire-at-65 paradigms with its early retirement goals.

- Living more modestly may facilitate a more fulfilling, less consumer-driven life.

- Understanding money as a tool can reshape perspectives on success and happiness.