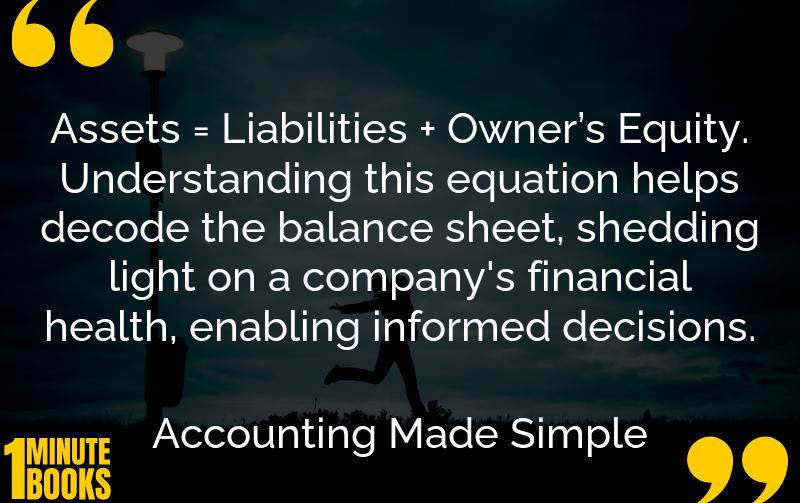

Accounting Made Simple breaks down complex accounting concepts into accessible content, covering key topics like accounting equations, balance sheets, income statements, and financial analysis.

Main Lessons

- Assets, liabilities, and owner’s equity are fundamental to understanding a company’s financial position.

- The balance sheet offers a snapshot of financial health at any specific time.

- Income statements reveal profitability by showing revenue minus expenses.

- Cash flow statements track the inflow and outflow of money within a business.

- Liquidity ratios assess a company’s capability to fulfill short-term obligations.

- Profitability ratios demonstrate how efficiently a company uses its resources for profit.

- GAAP includes double-entry accounting, crucial for accurate financial documentation.

- Debits and credits are used to record changes in accounts following accounting principles.

- The accounting equation remains consistent across different business sizes and types.

- Analyzing financial statements assists in making informed business and personal decisions.

- Financial ratios simplify evaluating a company’s stability and financial health.

- Mastery of basic accounting enables better analysis and prediction of financial outcomes.

- Understanding accounting concepts is essential for entrepreneurs and curious individuals alike.