Nassim Taleb’s ‘Fooled by Randomness’ explores how randomness influences financial markets and life decisions, highlighting biases and misconceptions that lead individuals astray.

Main Lessons

- Survivorship Bias: Success stories often overshadow failures, leading to skewed perception of strategies’ effectiveness.

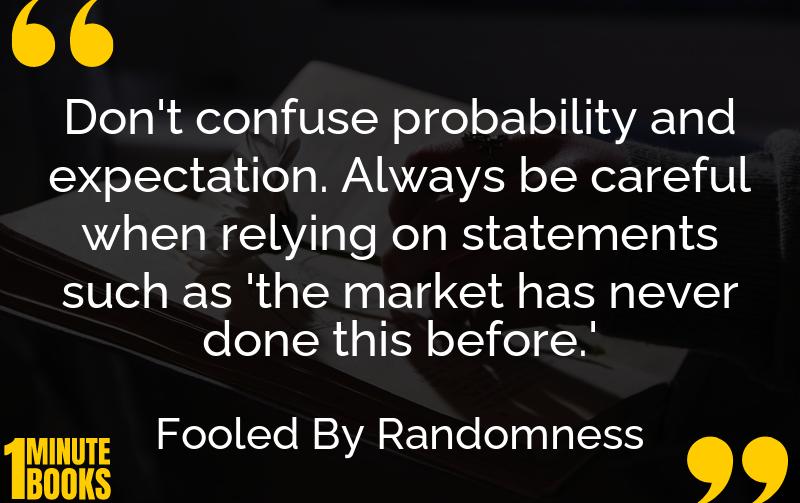

- Skewness Issue: Understanding probability vs. expectation is crucial; high payoff scenarios can justify unlikely events.

- Black Swan Problem: Rare, impactful events can dramatically shift outcomes; expect the unexpected.

- Pascal’s Wager: It’s wise to leverage successful historical strategies, but don’t rely on past data for risk assessment.

- Traits of a Market Fool: Overconfidence and ignoring randomness lead to poor investment decisions.

- Plan for Losses: Predefine risks to better manage unexpected market movements.

- Historical Data Usage: Utilize it for strategy, not for predicting risks, focusing on long-term viability.

- Changing Stories: Avoid shifts in investment narrative based on current position performance.

- Randomness in Markets: Acknowledge the role of luck in both success and failure in trading.

- Maximize Expectancy: Focus on strategies that enhance profit expectancy despite low probabilities.

- Be Skeptical: Challenge commonly held beliefs like ‘it hasn’t happened, thus it won’t happen.’