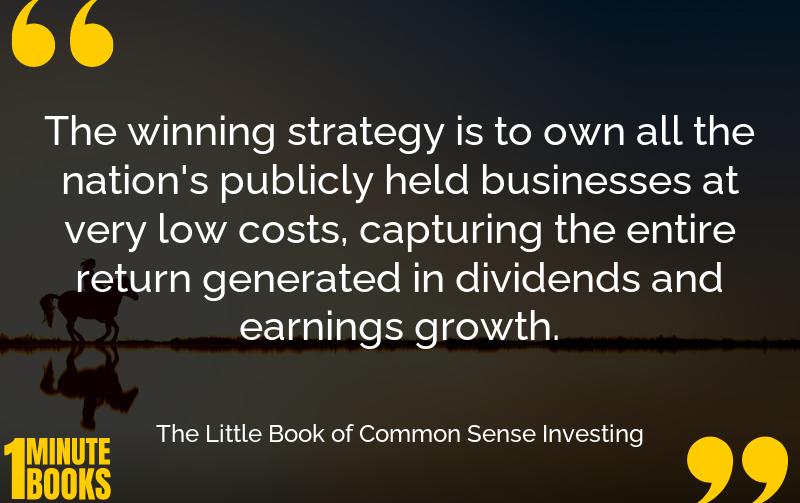

The book advocates for investing in low-cost index funds rather than actively managed mutual funds, emphasizing they offer greater returns over time due to their cost-effectiveness and reduced fees.

Main Lessons

- Investing in index funds assures capturing almost the entire market return.

- Lower costs in investing often lead to higher returns.

- Attempting to beat the market with active management is usually unsuccessful.

- Actively managed mutual funds tend to have high fees that erode returns.

- Index funds provide a tax-efficient way to invest with minimal trading.

- A vast majority of actively managed funds fail to surpass market performance long-term.

- Diversifying across the entire stock market helps mitigate sector-specific risks.

- Active trading introduces more volatility and less predictable returns.

- Investors should focus on long-term growth instead of short-term market timing.

- Even prominent investors like Warren Buffett endorse index fund investing.

- Cost-effectiveness is a key advantage of index funds over mutual funds.

- Index funds reduce the risks associated with fund manager turnover.

- Strategic diversification spreads risks and stabilizes investment returns.

- Individuals should reserve only a small portion of their portfolio for speculative investments.

- Long-term stability can be achieved through broad market index funds.