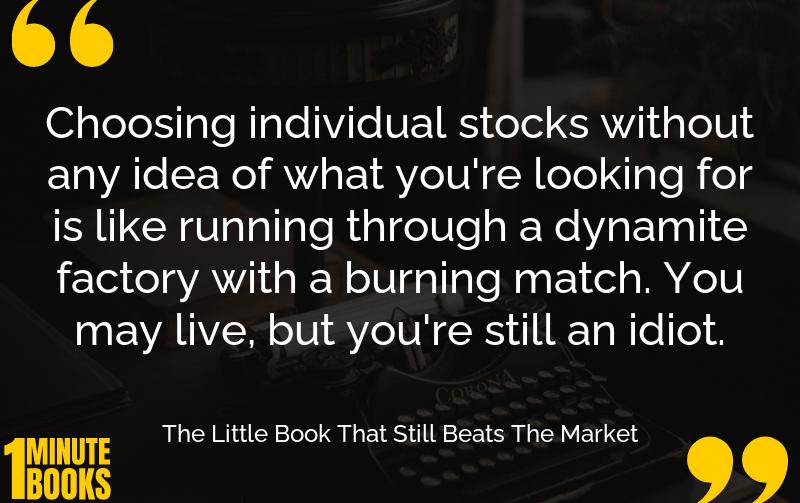

This book presents a simple, step-by-step formula for choosing stocks based on earnings yield and return on capital, aimed at generating long-term investment gains.

Main Lessons

- Value investing involves buying undervalued companies with growth potential.

- The ‘Magic Formula’ focuses on two metrics: earnings yield and return on capital.

- Higher earnings yield indicates more returns per investment dollar.

- Return on capital shows how much profit a company makes from its investments.

- Evaluate all major US listed companies using these metrics.

- Rank companies based on earnings yield and ROC for informed investment decisions.

- Combine rankings to identify top-performing companies.

- Invest in the top 20-30 companies and hold for a year.

- This approach requires patience and consistency to succeed.

- The formula’s effectiveness may fluctuate, with some years underperforming the market.

- Consistency is key, avoiding short-term trends in favor of long-term gains.

- Money managers might not use it due to client expectations for quick returns.

- Stick to the plan for potential millionaire growth in the long run.